Since the start of the pandemic, the U.S. government has allocated over $34 billon to improve U.S. medicines supply chain resilience. There has been significant attention paid to increasing onshoring and reducing reliance on foreign countries – China in particular.

In 2019, the U.S. Food and Drug Administration (FDA) shared data illustrating U.S. reliance on foreign active pharmaceutical ingredient (API) manufacturing based on where facilities were located. The FDA analysis showed that 72 percent of API facilities supplying the U.S. market are overseas, with 13 percent in China.

But has this geographic concentration changed given investments in medicines supply chain resilience over the past two years? Is the U.S. market still heavily reliant on foreign suppliers of APIs, even as we continue to invest in domestic API manufacturing and prepare for future crises? Now in year three of the pandemic, questions remain.

To address these questions, USP used its Medicine Supply Map to assess U.S. dependence on foreign API. The Medicine Supply Map identifies, characterizes and quantifies risk and resilience in the upstream medicines supply chain to aid early detection of risk factors that can lead to drug shortages.

The Medicine Supply Map analytics team used machine learning techniques, including Natural Language Processing, on FDA data, information from non-U.S. regulatory agencies, and its own proprietary insights to map manufacturing locations associated with ~90 percent of active API Drug Master Files (DMFs) around the world. DMFs are submitted to FDA by companies when they want to supply drug ingredients to another company without disclosing proprietary information. FDA publishes the names of companies filing the DMFs. While DMFs are commonly utilized in the generics industry, some manufacturers may choose to make their own API or not use a DMF. Nevertheless, this mapping provides a picture of U.S. reliance on foreign API sources at the end of 2021.

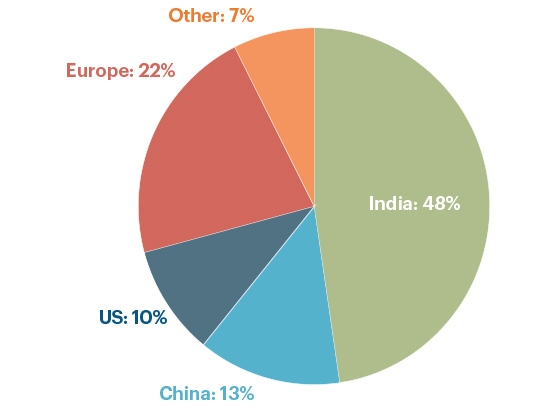

The USP Medicine Supply Map analysis (Chart I) counts the number of active API DMFs by location.

- India accounts for 48%

- China accounts for 13%

- U.S. accounts for 10%

Chart I: Total Active API DMFs, by country, as of 2021

Source: US Pharmacopeia Medicine Supply Map

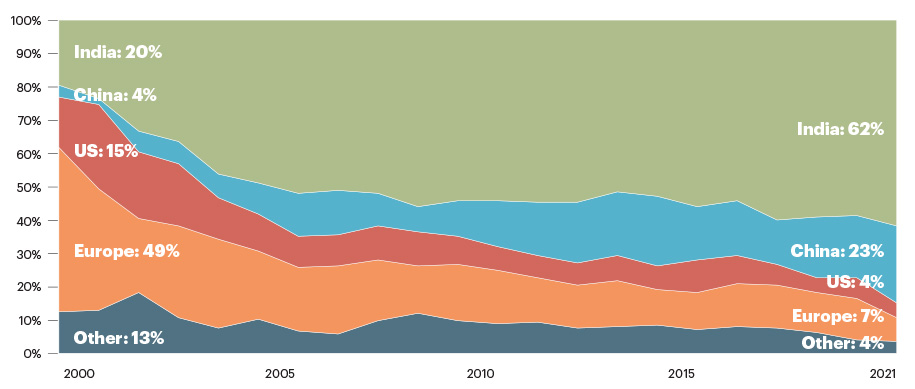

The Medicine Supply Map insights also show how U.S. reliance on foreign API sources has changed over time (Chart II).

Chart II: Active API Drug Master Files, by year of filing and country of manufacture

- India contributed 62% of active API DMFs filed in 2021, up from 20% filed in 2000. This increase is consistent with the country’s well-publicized national ambition to enhance API manufacturing capabilities.

- Europe’s contribution declined from 49% of active API DMFs filed in 2000 to 7% filed in 2021

- China contributed 18% of new API DMFs filed in 2019, and 23% filed in 2021

- U.S. contributed 4% of new API DMFs filed in 2019 and 2021

Such information and other insights provided by the USP Medicine Supply Map allow it to function as a first-of-its-kind information system for early warning of potential supply chain disruptions. It can be used by governments, providers and manufacturers to prioritize supply chain investments that reduce drug shortages.

Questions remain from the current analysis, however, when thinking about facets of U.S. reliance on foreign API manufacturers. For example, this analysis does not take volume into account, and it is not clear if certain DMF holders are responsible for larger volumes of drugs compared to competitors. The U.S. reliance on other countries for intermediates or raw materials used to make APIs is also not clearly understood. USP’s Medicine Supply Map team is working to map critical raw materials for essential APIs to better understand what risk these factors have for the medicines supply chain.

Learn more about USP’s Medicine Supply Map.