Antimicrobial resistance (AMR) is named one of the top 10 global health threats facing humanity by the World Health Organization and was associated with nearly 5 million deaths in 2019. With a challenge of this magnitude, it’s critical to have visibility in the supply chain for antimicrobials—medicines used to prevent and treat infections that include antibiotics (also known as antibacterials), antifungals, antivirals and antiparasitics.

USP’s Medicine Supply Map, composed of more than 250 million data points and spanning 92% of generic medicines approved in the United States, provides a dynamic view of the supply chain.

Our latest Vulnerability Insights Series analysis shows both an increased risk of shortages for some types of antimicrobials and the geographic concentration of facilities with active Drug Master Files (DMFs) for antimicrobials.

Antibacterials are at increased risk for shortage

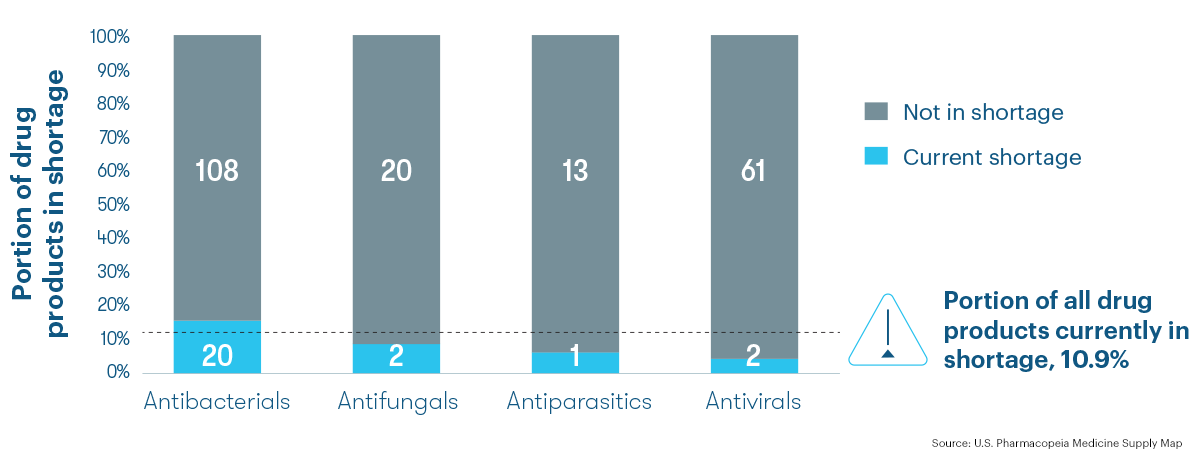

Antibacterials are 42% more likely to be in shortage than the average drug product. Out of the 128 antibacterial drug products in the U.S., 20 are currently in shortage. This constitutes 15.6% of all antibacterials in shortage compared to 10.9% for all drug products in the U.S.

Cephalosporins—a type of antibacterial—are at elevated risk for shortage, with 40% of active pharmaceutical ingredients (APIs) used for cephalosporins currently in shortage. Cephalosporins are listed among the WHO’s critically important microbials for human medicine.

Current Shortage Status by Antimicrobial Class as of May 17, 2022 (n=227 antimicrobial drug products)

Price drives shortage risk

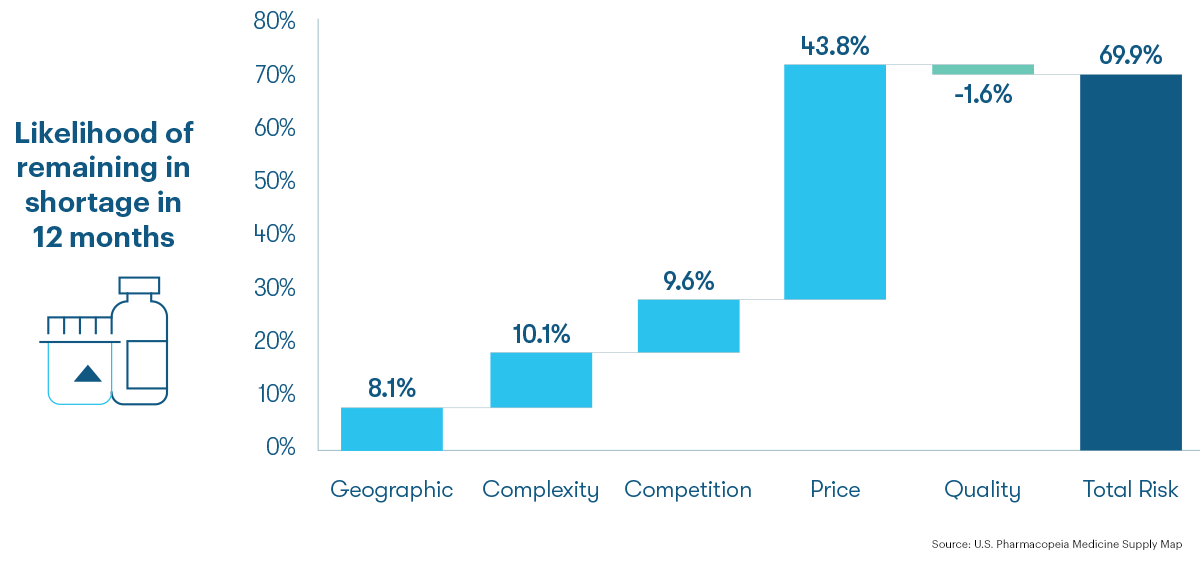

Across all types of antimicrobials, price is the leading risk factor for shortage. The 25 antimicrobial medications currently in shortage have an average 69.9% likelihood to remain in shortage 12 months from now with price accounting for the majority of that risk.

Average Shortage Risk for Antimicrobials Currently in Shortage (n=25 drug products)

In general, lower priced drug products have a higher risk of shortage. Low prices of antimicrobials can be a cause of a shortage because margin is not adequate to sustain manufacturing, according to a recent British Medical Journal article.

Substandard and falsified medicines also contribute to AMR. The presence of poor-quality medicines drives AMR primarily through sub-therapeutic dosing. When a patient takes a substandard antimicrobial, pathogens can evolve to become more resistant to them.

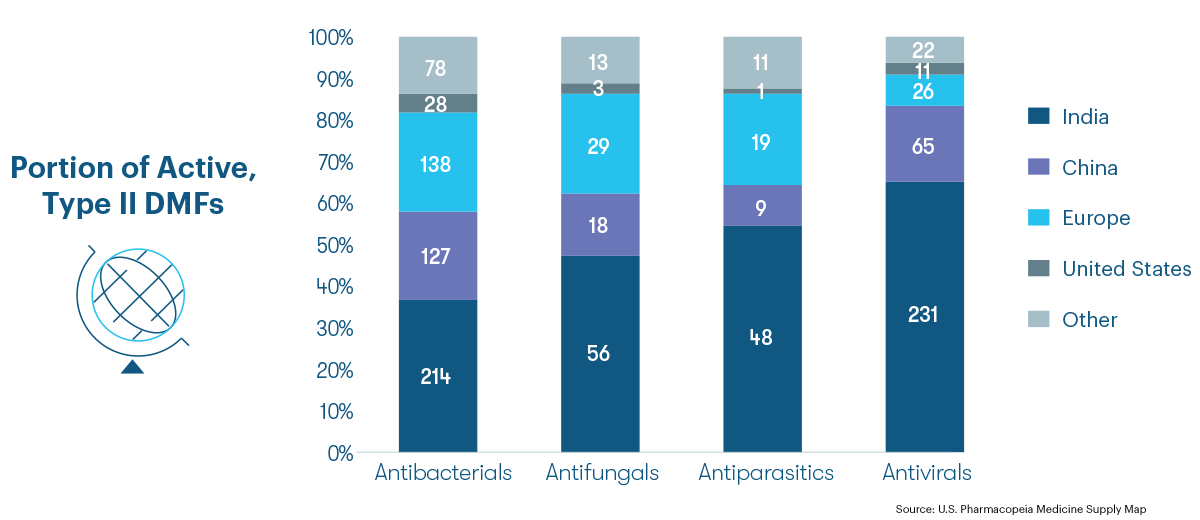

Active Drug Master Files are geographically concentrated in India and China

USP mapped DMF registrations to manufacturing facilities. Medicines are categorized according to the USP Drug Classification. Manufacturing facilities in India and China account for 67% of all active antimicrobial API DMFs. Among different types of antimicrobials, 83% of active API DMFs for antivirals and 58% for antibacterials are likely made in sites located in India and China.

Location of Antimicrobial API DMFs

DMFs are submissions to FDA used to provide confidential, detailed information about facilities, processes or articles used in the manufacturing, processing, packaging and storing of human drug products. DMF registrations are used as a proxy for manufacturing capacity in the Medicine Supply Map because they tell us which facilities have submitted data to the FDA to demonstrate their capacity to make an API. However, the Medicine Supply Map does not take volume or market share into account. For example, if two separate facilities are both associated with active DMFs for the same API, one facility could produce 90% or all the API.

As we have seen with the COVID-19 pandemic, infectious diseases do not honor geopolitical borders. Therefore, the emergence of AMR in one part of the globe could be a threat anywhere. Shortages of antimicrobials can contribute to the emergence and exacerbation of AMR, so strategies such as strengthening supply chain resiliency and improving antimicrobial stewardship—among others—are critical.

As policymakers consider how to prepare for this next public health crisis, it’s important to understand the state of the antimicrobial supply chain. Further investigation into the U.S.’ reliance on other countries for intermediates or raw materials used to make APIs would offer a more robust picture of the supply chain for antimicrobials and all drug products used by patients in the U.S.

Request a demo of Medicine Supply Map now: