The frightening words, “you have cancer”, will be heard by approximately 2 million people in the U.S. this year alone. While novel cancer therapies offer hope to patients, the U.S. is facing a shortage of medicines that have been the backbone of cancer treatment plans for decades.

New drug shortages in the U.S. increased nearly 30% from 2021 and 2022, marking the highest level of shortages in five years, according to data from the American Society of Health-System Pharmacists. Currently, there are 16 cancer drugs that are on the U.S. Food and Drug Administration’s (FDA) shortage list.

Some hospitals have reported rationing doses in response to these shortages, and the American Society of Clinical Oncologists (ASCO) has issued new clinical guidance for treating patients with gastrointestinal (GI) cancers, which are commonly treated with carboplatin and cisplatin, two chemotherapy agents currently in shortage nationwide.

On September 26, 2023, the American Cancer Society (ACS), American Cancer Society Cancer Action Network (ACS CAN) and the USP Convention hosted a discussion with pharmaceutical supply chain experts to better understand cancer drug shortages and explore opportunities that could improve access to lifesaving treatments, actions to mitigate today’s shortages, and prevent future impact. .

Data on structural vulnerabilities in the supply chain

USP shared data on vulnerabilities in the supply chains of 20 essential cancer medications, identified in a survey by 948 oncologists from around the world. All, except two of the medicines, are on the WHO Essential Medicines List1.

Four of the 20 essential cancer medicines are currently in shortage, according to the FDA. Analysis leveraging USP’s Medicine Supply Map suggests many of the essential cancer medicines have inherently vulnerable supply chains and are at greater risk for shortage compared to other generic medicines.

The USP Supply Vulnerability Score is calculated based on more than 100 risk factors to predict the likelihood of a shortage for a given drug. The closer the risk score is to 100%, the greater the risk for that drug to be in shortage in the next 12 months.

The score can help stakeholders, including hospitals, distributors, manufacturers, and the U.S. government, prioritize mitigative actions for the medicines most at risk of drug shortage (e.g., holding additional stock, securing multiple suppliers and offering long-term contracts). The scores indicate drivers of risk – for example, low price or production concentration – so that targeted actions can be taken.

The average prescription drug product in the United States has a risk score of approximately 20%. Seven of the 20 essential cancer medicines analyzed are 3 to 5 times more likely to be in shortage than the average medicine. See Table 1 for the list of medicines and the detailed analysis.

Table 1: Cancer medicines analyzed, USP Supply Chain Vulnerability Score and Shortage Status as of September 14, 2023

|

Rank |

Drug |

USP Supply Chain Vulnerability Score1 |

Current shortage? |

|

1 |

Doxorubicin |

93% |

|

|

2 |

Cisplatin |

60% |

Yes |

|

3 |

Paclitaxel |

90% |

|

|

4 |

Pembrolizumab |

NA |

|

|

5 |

Trastuzumab |

NA |

|

|

6 |

Carboplatin |

68% |

Yes |

|

7 |

5-fluorouracil |

82% |

|

|

8 |

Tamoxifen |

9% |

|

|

9 |

Capecitabine |

47% |

Yes |

|

10 |

Cyclophosphamide |

28% |

|

|

11 |

Docetaxel |

74% |

|

|

12 |

Oxaliplatin |

28% |

|

|

13 |

Dexamethasone |

95% |

Yes |

|

14 |

Nivolumab |

NA |

|

|

15 |

Rituximab |

NA |

|

|

16 |

Imatinib |

24% |

|

|

17 |

Gemcitabine |

15% |

|

|

18 |

Etoposide |

48% |

|

|

19 |

Osimertinib |

<1% |

|

|

20 |

Letrozole |

13% |

* Drugs with NA USP Vulnerability Scores were not in scope for shortage prediction. They are biologic drugs and Medicine Supply Map excludes biologics products from the prediction.

Drivers of risk in the cancer drug supply chain

One reason for the generally high scores of the essential cancer medicines is their manufacturing complexity. Cancer-fighting drugs, antineoplastics, are harmful to human cells by design – and the protocols to ensure worker safety in the factories where they are made, are stringent.

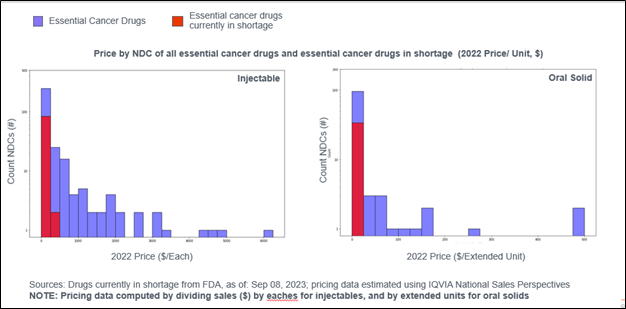

Another reason is low price. As Graph 1 shows, all the drugs currently on the FDA drug shortage list have very low prices. For essential cancer drug injectables in shortage, the average price is $2 per each vial. In contrast, essential cancer injectables that are not on the FDA shortage list have a price of $1,423 per each vial. For solid oral medicines, the difference is less dramatic but still noteworthy: the average cost of an oral solid in shortage is $1 per extended unit (per pill), while those not in shortage have an average price of $7.50 per extended unit (per pill)2.

Graph 1: Price by National Drug Codes (NDCs) of all essential cancer drugs and cancer drugs in shortage

A third contributor to shortage risk is production concentration. The USP Medicine Supply Map’s geographical analysis of manufacturing locations of medicines and their ingredients currently accounts for the production locations of 91% of finished dose forms of prescription drugs and 44% of the Active Pharmaceutical Ingredient (API) manufacturer locations.

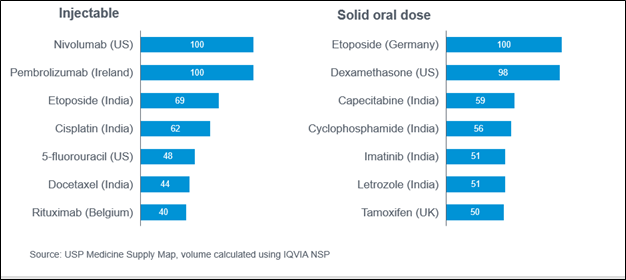

Analysis of the production locations for the essential cancer medicines showed that several cancer medicines are each produced in a single facility (Graph 2).

Graph 2: US volume share of top producing facility and facility location for select essential oncology medicines (%, 2022)

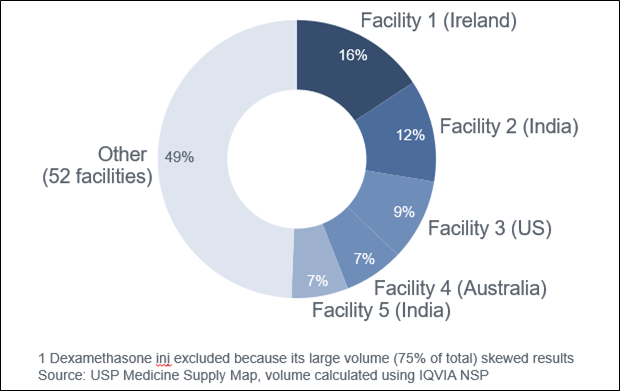

Some of these facilities are responsible for the production of multiple cancer medicines and represent nodes of high vulnerability for the cancer medication supply chain (Graph 3). For example, a single U.S. facility was responsible for:

- 48% of the US supply of 5-fluorouracil

- 20% of dexamethasone

- 17% of cisplatin

- 7% of doxorubicin

Graph 3: Manufacturing distribution of essential cancer injectables (% of facility volume share, 2022)

Serving supply chain intelligence across industry

USP’s Medicine Supply Map provides supply chain intelligence to health systems and hospitals, manufacturers and contract development and manufacturing organizations (CDMOs), to distributors and to government entities.

Medicine Supply Map can help:

- Health systems and hospitals gain more time for contingency planning with early visibility into medicines affected by supply disruptions

- Manufacturers and CDMOs make more informed planning and production decisions by understanding which drugs might be at risk of drug shortage

- Distributors control costs while helping to design continuity plans that avoid medicines supply disruptions

- Governments inform policy and investments that help prevent or mitigate drug shortages, improve medicine supply chain resiliency, and strengthen national security

Solutions to bolster supply chain resilience

To combat vulnerabilities in cancer and other essential medicines, USP supports a holistic approach:

- Build early warning capabilities using predicative analytics to identify and prioritize shortage prevention for vulnerable meds

- Establish a vulnerable medicines list based on predictive analytics (or early warning indicators) that accounts for supply chain vulnerabilities

- Design mitigation strategies targeted towards specific vulnerabilities, for example:

- Invest in long-term contracts for medicines with unsustainably low prices

- Invest in measures that encourage utilization of multiple suppliers, geographic diversification of manufacturing, and redundancies

Read USP’s position paper to learn more about policy reforms that could strengthen the global medicines supply chain.

Request a demo of Medicine Supply Map now:

1 - Access to cancer medicines deemed essential by oncologists in 82 countries: an international, cross-sectional survey”, The Lancet, 2021

2 - IQVIA National Sales Perspective, 2022